In the dynamic landscape of modern enterprises, the ability to model and optimize business processes is crucial for maintaining a competitive edge and ensuring operational efficiency. ArchiMate, a powerful enterprise architecture modeling language, provides a structured and visual approach to understanding and improving complex organizational workflows. This case study delves into the application of ArchiMate to model the claim processing system of an insurance company, ArchiSurance. By illustrating the interactions between business, application, and technology layers, this study demonstrates how ArchiMate can be used to identify inefficiencies, streamline processes, and align IT strategies with business goals. Through this comprehensive exploration, we aim to showcase the practical benefits of ArchiMate in driving operational improvements and strategic decision-making within an enterprise architecture framework.

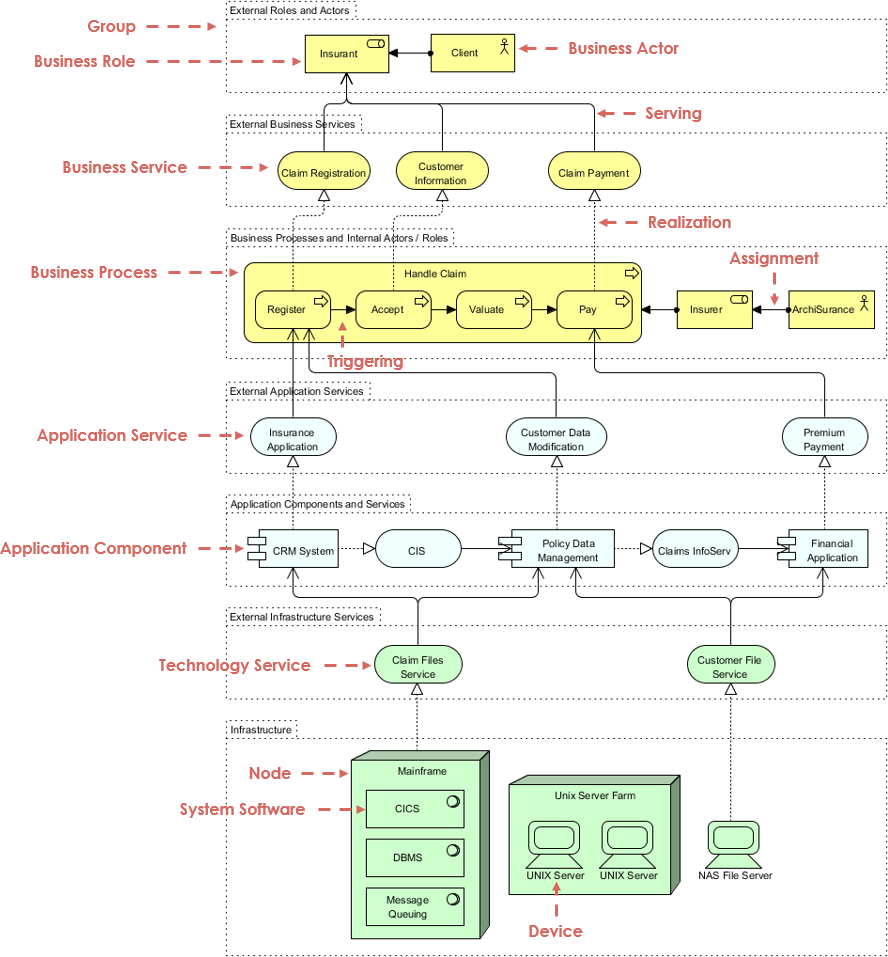

This case study explores the application of ArchiMate for modeling the enterprise architecture of an insurance company, focusing on the claim processing workflow. The diagram illustrates how ArchiMate can be used to represent the interactions between business, application, and technology layers, providing a comprehensive view of the enterprise architecture.

Background

ArchiSurance is an insurance company that aims to streamline its claim processing system to improve efficiency and customer satisfaction. The company seeks to model its current claim processing architecture using ArchiMate to identify areas for improvement and ensure alignment between business processes and IT infrastructure.

Key Concepts and Components

Business Layer

-

Business Role and Business Actor

- Insurance Company (Business Role): Represents the role of the insurance company in the claim processing workflow.

- Client (Business Actor): Represents the customer who initiates the claim process.

-

Business Service

- External Business Services:

- Claim Registration: The service through which a client registers a claim.

- Customer Information: The service that manages customer data.

- Claim Payment: The service responsible for processing payments to the client.

- External Business Services:

-

Business Process

- Handle Claim: The core business process that includes the following sub-processes:

- Register: The initial step where the claim is registered.

- Accept: The claim is reviewed and accepted for processing.

- Valuate: The claim is evaluated to determine the compensation amount.

- Pay: The payment is processed and disbursed to the client.

- Handle Claim: The core business process that includes the following sub-processes:

-

Business Object

- Insurance: Represents the insurance policy or claim details that are central to the claim processing workflow.

Application Layer

-

Application Service

- External Application Services:

- Insurance Application: Supports the claim registration and management processes.

- Customer Data Modification: Manages updates to customer information.

- Premium Payment: Facilitates the processing of premium payments.

- External Application Services:

-

Application Component

- CRM System: Manages customer relationships and interactions.

- CIS (Claim Information System): Manages claim-related information.

- Policy Data Management: Manages policy data and updates.

- Claims InfoServ: Provides information services related to claims.

- Financial Application: Manages financial transactions, including claim payments.

Technology Layer

-

Technology Service

- External Infrastructure Services:

- Claim Files Service: Manages the storage and retrieval of claim files.

- Customer Files Service: Manages customer-related files and data.

- External Infrastructure Services:

-

Node and System Software

- Mainframe: Hosts core applications and data processing.

- UNIX Server Farm: Provides server infrastructure for running applications.

- NAS File Server: Provides network-attached storage for file management.

-

Device

- UNIX Server: Individual servers within the UNIX server farm.

Relationships and Interactions

-

Serving: Indicates that a business service is provided to a business actor or role.

- Example: The “Claim Registration” service is provided to the “Client.”

-

Realization: Shows how a business process is realized by application services.

- Example: The “Handle Claim” process is realized by the “Insurance Application.”

-

Assignment: Indicates that a business role is assigned to a business actor.

- Example: The “Insurance” role is assigned to “ArchiSurance.”

-

Triggering: Indicates that a business event triggers a business process.

- Example: The registration of a claim triggers the “Handle Claim” process.

-

Access: Indicates that a business process accesses a business object.

- Example: The “Handle Claim” process accesses the “Insurance” business object.

Analysis and Optimization

By modeling the claim processing architecture using ArchiMate, ArchiSurance can identify potential inefficiencies and areas for improvement. For example, the diagram highlights the interactions between different layers, allowing the company to pinpoint bottlenecks in the claim valuation and payment processes.

Findings and Actions

| Finding | Action to be Taken |

|---|---|

| Inefficiencies in the claim valuation process. | Implement automated valuation tools to streamline the process and reduce manual intervention. |

| Delays in claim payment processing. | Integrate real-time payment processing systems to expedite payment disbursement and improve customer satisfaction. |

| Lack of real-time data access for decision-making. | Enhance data management systems to provide real-time access to claim and customer data for better decision-making. |

| Redundant data entry across systems. | Implement data integration solutions to eliminate redundant entries and ensure data consistency across systems. |

| Limited visibility into claim status for customers. | Develop a customer portal to provide real-time updates on claim status, improving transparency and customer experience. |

| Inadequate communication between business and IT teams. | Foster cross-functional collaboration through regular meetings and workshops to align business and IT strategies. |

| Outdated technology infrastructure. | Upgrade technology infrastructure to support modern applications and improve system performance and reliability. |

| Insufficient training for staff on new systems. | Provide comprehensive training programs for staff to ensure proficiency in using new systems and technologies. |

This table summarizes the key findings from the ArchiMate modeling of ArchiSurance’s claim processing system and outlines the actions to be taken to address these issues. By implementing these actions, ArchiSurance can enhance operational efficiency, improve customer satisfaction, and align IT strategies with business goals.

Conclusion

This case study demonstrates how ArchiMate can be used to model the enterprise architecture of an insurance company, focusing on the claim processing workflow. By providing a comprehensive view of the interactions between business, application, and technology layers, ArchiMate helps ArchiSurance identify opportunities for optimization and ensure alignment between business processes and IT infrastructure. This holistic approach supports strategic decision-making and operational efficiency, driving improvements in customer satisfaction and operational performance.